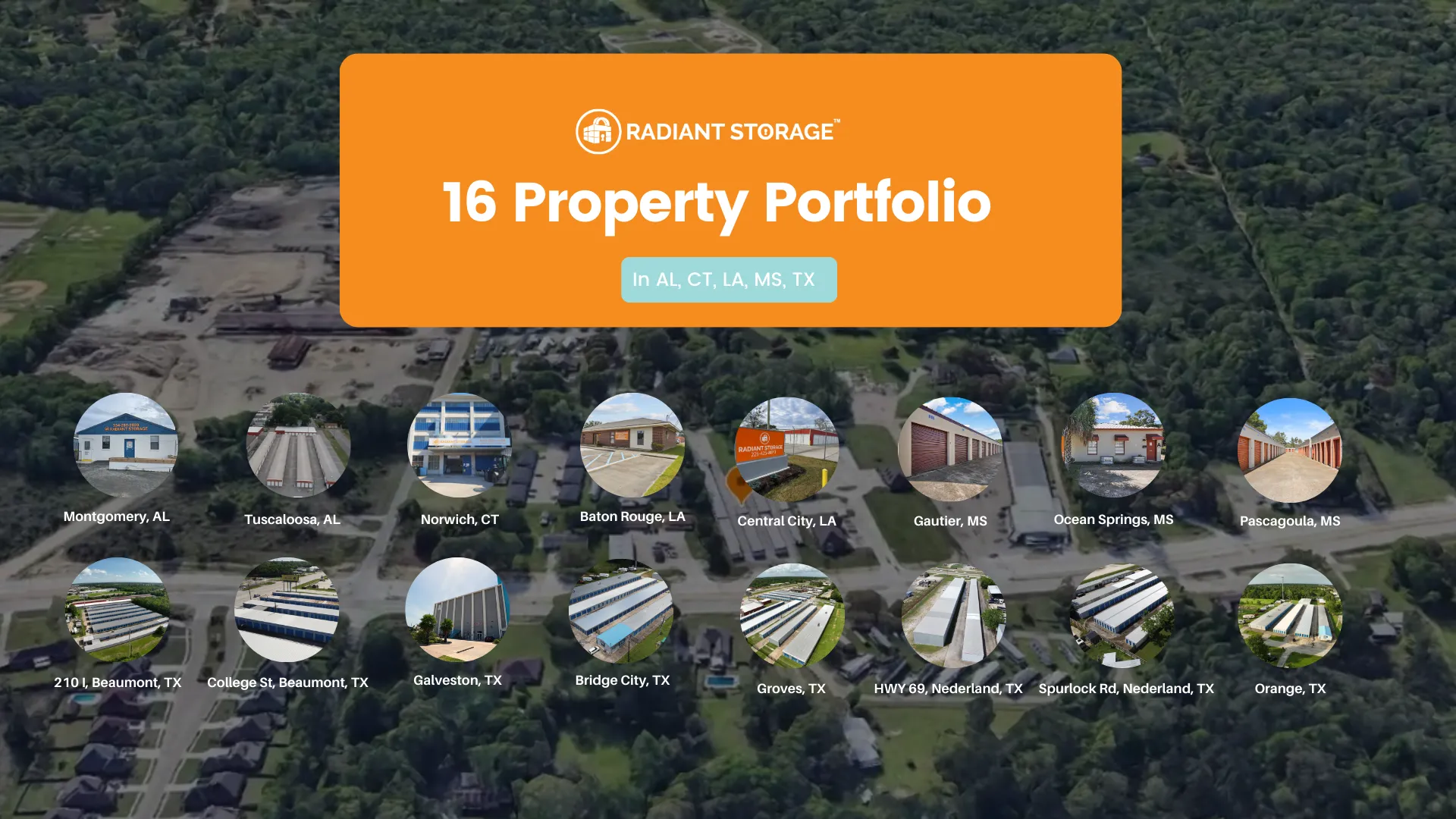

Behind the Vision: Radiant Storage Team

Powell Chee

Managing Partner

Meet Powell, a dynamic real estate enthusiast with an impressive track record. Leading 16 self storage facilities and partnering in seven multifamily properties, he's not just about properties – he's a creator too. He founded MultifamilyMasters.com, a thriving meetup group with over 17,000 members. Powell's achievements extend beyond real estate; he holds two master degrees, has clinched sales awards for Fortune 500 companies, and even secures family time in sunny Orange County, CA.

Won Yang

Managing Partner

Meet Won, a seasoned professional with a diverse real estate and business background. As a general partner, he oversees five multifamily communities totaling 900 units, achieving exceptional results in three full cycles. Won is also a co-founder of Radiant Storage, managing eight self-storage facilities with over 2,000 units. An honorably discharged US Army veteran, he ventured into real estate after successfully managing a specialty clothing company, now dedicated to his thriving real estate ventures.

Our Investment Focus

At Radiant Invest, our investment strategy is designed to deliver sustainable growth and attractive returns for qualified purchasers. We carefully select assets across a range of sectors that align with our mission to maximize value for our investors. Our core investment categories include:

Self Storage Facilities

Self storage facilities are an attractive addition to our portfolio due to their recession-resistant nature and the growing demand for storage solutions. These investments offer a unique combination of steady income and potential for capital appreciation.

Businesses

Radiant Invest also explores investment opportunities in businesses across various industries. We believe in supporting entrepreneurship and innovation, and we invest in businesses with strong growth potential and sound fundamentals.

Multi-Family Properties

Multi-family properties, such as apartment complexes and residential communities, are a cornerstone of our portfolio. We invest in these assets because they offer stable cash flows, long-term growth potential, and provide essential housing needs for communities.

Commercial Real Estate:

Our commitment to commercial real estate investments is driven by the diversity of opportunities it presents. From office spaces to retail centers, we leverage our expertise to identify prime locations and assets with the potential for value appreciation and consistent rental income.

-

Diversification: Diversifying across multi-family properties, commercial real estate, self-storage facilities, and businesses helps spread risk, ensuring more stable returns and reducing vulnerability to economic fluctuations.

-

Income and Appreciation: These assets offer a mix of consistent income through rent or cash flow and the potential for property appreciation or business growth, creating a balanced investment approach.

-

Market Demand: We focus on assets with demonstrated and sustained demand. Housing, commercial spaces, storage solutions, and innovative businesses are all essential components of modern life, making them resilient even in challenging economic conditions.

Why We Invest in These Assets

Our investment choices are driven by a deep understanding of market dynamics, risk mitigation, and our commitment to generating value for our investors. Here's why we choose to invest in these asset classes:

Investing Made Simple: Our Step-by-Step Process

Schedule a Free Consultation Call

Ready to take the plunge into self-storage investing? Begin by booking a complimentary consultation call. Our team is eager to understand your unique goals and preferences. Through this call, we'll craft a tailored strategy that aligns perfectly with your vision, ensuring your investment journey starts on the right foot.

Discuss Options and Strategies

Delve into the realm of self-storage investing with an in-depth discussion. Our seasoned professionals will guide you through the array of options available, whether you're an experienced investor or new to the field. By understanding your aspirations and aligning them with the most suitable opportunities, we'll help you make a well-informed decision that sets you up for success.

Sign Up and Invest in the OMNI Fund

Ready to turn your dreams into tangible investments? Take the leap by signing up for the Omni Fund. This step opens the door to a world of self-storage investment possibilities. With our proven track record and expert insights, you can confidently take part in shaping the future of self-storage. Join today to secure your position at the forefront of storage success.

Investors Testimonials: Sharing Their Journey

Frequently Asked Questions

Self-storage investing offers unique advantages for passive investors. Unlike traditional residential or commercial real estate, self-storage facilities typically require lower maintenance costs, have a steady demand irrespective of economic conditions, and can generate consistent rental income. Additionally, they often have shorter tenant lease terms, allowing for more flexible adjustments to market conditions.

Copyright 2023. All Rights Reserved